interest tax shield example

Thus there is a tax savings referred to as the tax shield. 1000 100-30.

The Effect Of Gearing Week Ppt Video Online Download

Depreciation tax shield 30 x 50000 15000.

. Interest Interest Tax Shield c f c f f c r D PV r r D 182 PRESENT VALUING THE INTEREST TAX SHIELD TERM DEBT EXAMPLE Firm A borrows a 10 million for 5 years at the risk-free rate of 4. Tax rate is 30. For example a mortgage provides an interest tax shield for a property buyer because interest on mortgages is generally deductible.

Basically the company uses two main tax shield strategies. Companies pay taxes on the income they generate. For example there are some cases where mortgages have an interest tax shield for the buyers as the mortgage interest is deductible on the income.

The most important financing side effect is the interest tax shield ITS. For example For a company with a 15 loan of 200000 and a tax rate as 25 the tax shield approach will be 15 x 200000 x 25 7500. Tax Shield Example for Individual.

In the DCF analysis the ITS are baked in by including the tax-effected cost of debt in the WACC used to discount free cash flows FCF. Calculating the tax shield can be simplified by using this formula. After 5 years the debt is repaid not extended.

By how much does the borrowing enhance the firm value. Tax shields differ between countries and are based on what deductions are eligible versus ineligible. A companys interest payments are tax deductible.

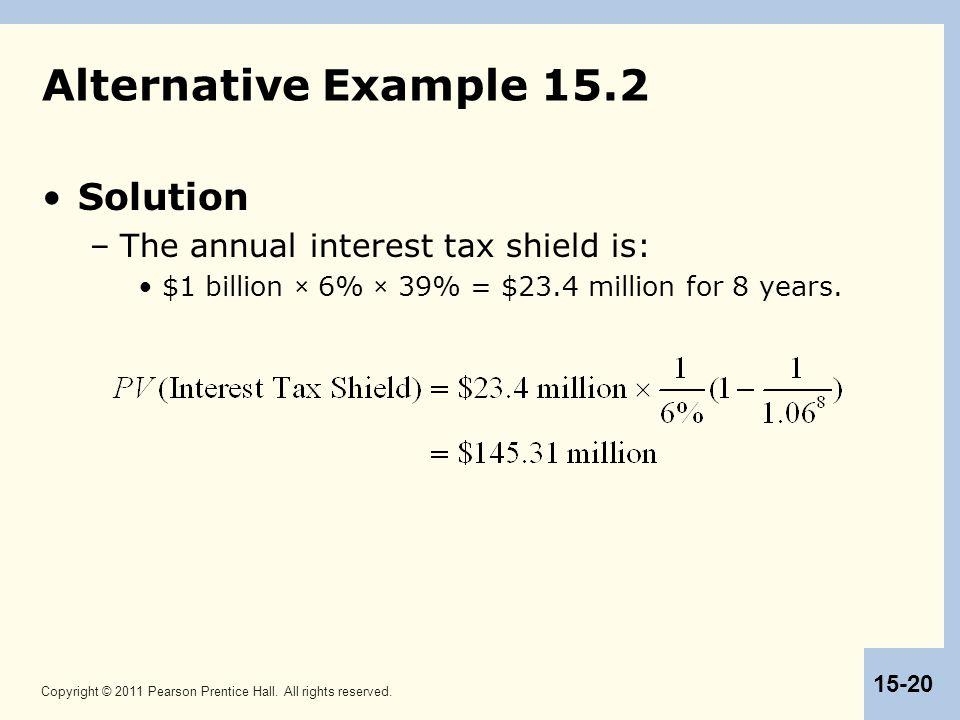

So the cash outflow which will consider for discounting would be. Interest Tax Shield Interest Expense Tax Rate. Example 164 Valuing the Interest Tax Shield Execute.

Interest Tax Shield A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income. Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage interest and your tax. This companys tax savings is equivalent to the interest payment multiplied by the tax rate.

Cash Outflow in Year 1 Annual repayment Depreciation tax shield Interest tax shield 12063 30000 333 35 30000 10 35 7513 Cash outflow in year 2 12063 30000 333 35 30000 12063 3000 10 35. Interest is a reduction to net income on the income statement and is tax-deductible for income tax purposes. If a company has zero debt and EBT of 1 million with a tax rate of 30 their taxes payable will be 300000.

Use these articles to find and calculate the corporate tax rate and individual tax rates for the current year. Examples of taxable expenses used as a tax shield are as follows. Interest Tax Shield Example A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate.

Tax shields do not only benefit the wealthy however. Businesses as well as individuals may choose to utilize this type of shield as a means of choosing how to finance different purchases and projects simply to maximize the amount of. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed.

For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. The tax savings are calculated as the amount of interest multiplied by the tax rate. Many middle-class homeowners opt to deduct their mortgage expenses thus shielding some of their income from taxesAnother example is a business may decide to take on a mortgage of a building rather than lease the space because mortgage interest is deductible thus serving as a tax shield.

This is also termed as an interest tax shield approach which will be studied in brief later. The impact of adding removing a tax shield is highly impacted by the companys optimal capital structure which is a mix of debt and equity fundingMoreover the interest expense on the debt is tax deductible which makes the. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate.

That is the interest expense paid by a company can be subject to tax deductions. 1000000 1-03 700000 of earnings and pays 300000 of tax The company would not be able to deduct any interest expense. Thus interest expenses act as a shield against the tax obligations.

An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation. Interest tax shields refer to the reduction in the tax liability due to the interest expenses. The interest tax shield each year is 35 120 million 42 million.

For example if you expect interest on a mortgage to be 1200 for the year and your tax rate is 20 the amount of the tax shield would be 240. Let us look at a detailed example when a company prepares its tax income 1 accounting for depreciation expense and 2 not taking depreciation expense. Example The interest tax shield provides a benefit to using leverage.

For example an all-equity financed company with 1000000 of pre-tax earnings and a 30 tax rate would receive. When a company has debt the interest it pays on that debt that is tax-deductible creating interest tax shields that have value. Case 1 Taxable Income with Depreciation Expense.

Suppose a cash outflow interest or salary expenses is 1000- and the rate of income tax is 30 percent. As such the shield is 8000000 x 10 x 35 280000. Paying out funds for charitable contributions to charge off the contributions as a taxable expense Incurring debt in order to charge off the related interest expense as a taxable expense Incurring medical expenses in order to.

Interest expenses via loan and mortgages are tax deductible meaning they lower the taxable income. Such a deductibility in tax is known as interest tax shield. This is equivalent to the 800000 interest expense multiplied by 35.

This tax shield example template shows how interest tax shield and depreciated tax shield are calculated.

Chapter 15 Debt And Taxes Ppt Download

The Interest Tax Shield Explained On One Page Marco Houweling

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shields Meaning Importance And More

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Solved Example Interest Tax Shield Annual Interest Tax Chegg Com

Tax Shield Formula How To Calculate Tax Shield With Example

What Is A Tax Shield Depreciation Tax Shield Youtube

Tax Shields Financial Expenses And Losses Carried Forward

Tax Shield Meaning Importance Calculation And More

Interest Tax Shield Formula And Excel Calculator

What Is The Depreciation Tax Shield The Ultimate Guide 2021